Markoni Trading Indicator: Ultimate Guide to Profitable Trades

Introduction

Trading could be either fascinating and scary at the same time. And so do so many traders who are searching for good tools that could genuinely help them improve their strategies. One such tool, which might assist a trader in carrying out a strategy, is the Markoni Trading Indicator. This article will take you through what the Markoni Trading Indicator is, how it works, and how to apply it in making profitable trades.

Understanding the Markoni Trading Indicator

What is the Markoni Trading Indicator?

It is a technical trading tool that combines and follows a mean-reversion strategy. Markoni is a trend-follower that has been able to identify certain short-term trading opportunities in stocks, forex, and commodities through specific mean-revision and trend signals that the indicator offers. The Markoni indicator is believed to provide adequate entries and exits for trades due to its integrated features from different existing indicators.

Key Components

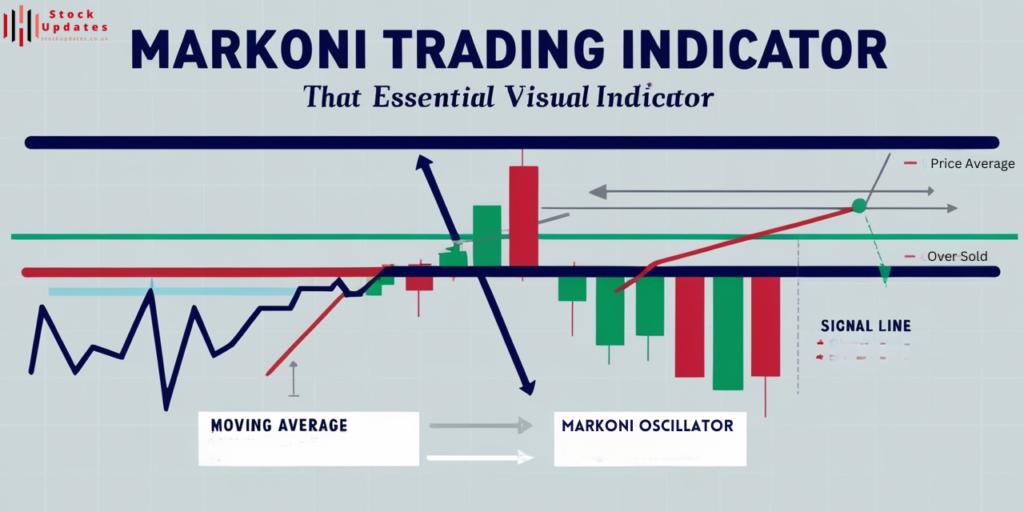

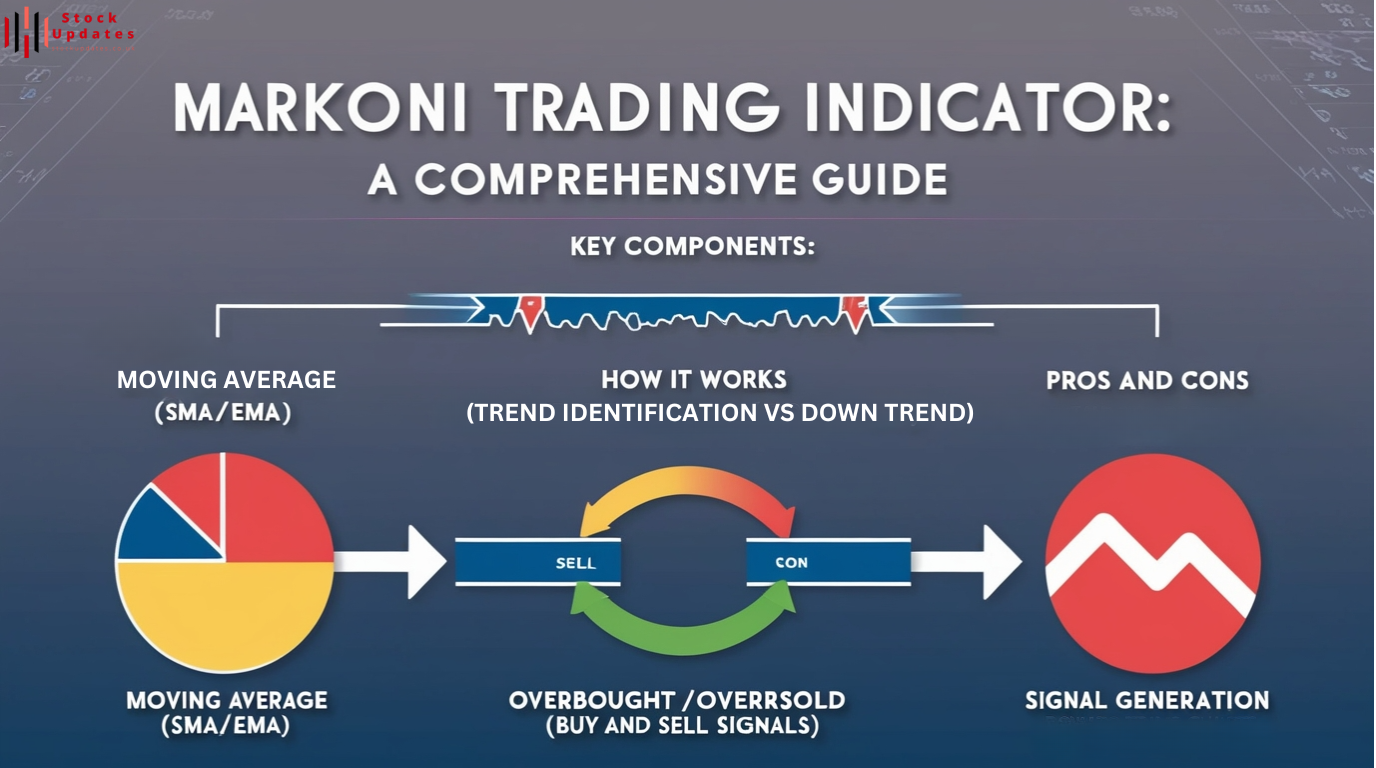

The Markoni trading indicator has three main parts as follows:

- Moving Average: It may either be Simple Moving Average or Exponential Moving Average. The moving average reflects a running average price over an established period and therefore helps in determining the direction of the general trend.

- Markoni Oscillator: The calculated value would be the difference between the current price and its respective moving average. Its task is to mark out the overbought and oversold status of the price relative to the trend.

- Signal Line: This is usually a smoothed moving average of the Markoni oscillator. The oscillator would thus generate a buy or sell signal each time it crossed above or below the signal line.

How Markoni Trading Indicator Work

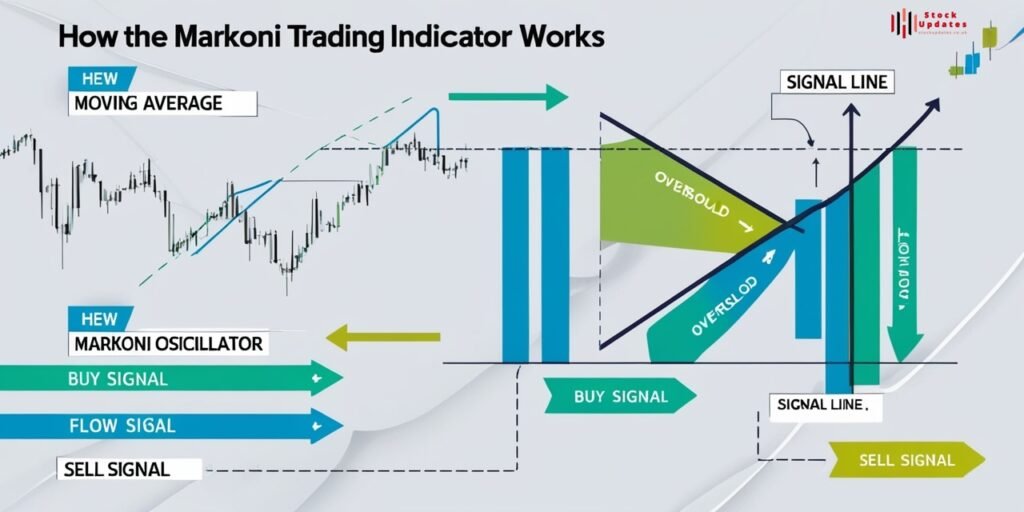

Trend Identification

The Markoni Trading Indicator is established by first identifying the dominant trend of price movement. If the price tends to stay above the moving average, then it means a positive trend. Conversely, if the price starts going below the moving average, then it means a negative trend. This is a basic yet proper methodology through which traders can gain the judgment of whether they should search for buying or selling opportunities.

Then, the contribution made by the Markoni oscillator in estimating market conditions is vital. The price is given to be overbought as long as it is above the signal line. This can be an indication of whether it might soon change its stance regarding the price trend. In contrast, when the oscillator line appears to be below the signal line then the price is said to be oversold. That is a signal for buying.

Signal Generation

It is one of the most crucial functions of the this Indicator. When the Markoni oscillator crosses above the signal line, it forms a buy signal. This serves as an entry point for a long position; otherwise, a crossover below the signal line acts as an indicator to produce a sell signal, and as such, there may be an opportunity to enter a short position.

Advantages of Markoni Trading Indicator

Advantages of the Markoni Trading Indicator There are various factors that make the Markoni indicator appealing to traders:

- Combines Strategies: The Markoni indicator combines features of a mean-reversion type and a trend-following type; due to the above, it adjusts according to market conditions. Therefore, there is an improvement in the level of success in a given trading session.

- Identifies Potential Reversals: A trading indicator can be applied to recognize the tendencies to reverse in trends prior and that will allow an earlier change in positions.

- Provides Clear Signals: the Markoni Oscillator over crossings and the line mark easy Buy and sell hints. Thus, it can minimize instances of confusion a while before making a trading decision.

Disadvantages of the Markoni Trading Indicator

As much as this indicator has gained popularity, it has several flaws:

- Lagging indicator: since the Markoni uses the average moving it lags behind due to price movements. Further, this lag may cause this indicator to miss some trading opportunities, especially in fast markets with price fluctuations.

- Sensitivity to Settings: The indicator’s strength relies on the selected parameters namely, the length of the moving average and that of the signal line. As both parameters are adjustable, they may need some adjustment by a trader to result in optimum performance.

- Market Noise: The indicator is likely to give false signals during times of high volatility. Caution would be necessary as well as prior consideration of other market conditions before the decision to buy or sell through the Markoni indicator is implemented.

Setting Up the Markoni Trading Indicator

Installation and Configuration

To get started with the Markoni Trading Indicator, you must install it on your trading software. Most trading softwares allow users to personalize their indicators. This is a quick guide:

- Open Your Trading Software: Open the trading software that you like best, for example Meta Trader or Trading View.

- Find the Indicators Section: Go to the area of your trading software where you can find the indicators.

- Locate the Markoni Indicator: You then download it from a reputable website if it is not already pre-installed.

- Insert the Indicator into Your Chart: Once you download it, insert the Markoni Trading Indicator into your chart. You can then adjust the indicators according to your specifications.

Customizing Settings for Optimal Performance

After installation, you can configure the settings of the indicator suited to optimize performance in each style of trading. In general, some recommendations on customizing the indicator’s setting include:

- Adjust Moving Average Periods: A fast MA is normally set at 5-periods, while a slow MA is set at 20-periods. Though you may try different periods to see that works best for your trading strategy.

- Set the RSI Period: Generally, a 14-period RSI is used but you can always set it based on your analysis

- Test Different Configurations: Do some back testing and test different configurations to find that which best fits your trading style.

Strategies for Using the Markoni Trading Indicator

Combining with Other Indicators

One of the best ways that can be used to implement the Markoni Trading Indicator is in a combination with other technical indicators. It can be used together with support and resistance levels as well as trend lines, and even on candlestick patterns. This will give you more than just confirmation of trading decisions.

Developing a Trading Plan

Now, in order for the Markoni Trading Indicator to work out the best, the right trading plan should be created. Below is the way you cand do it:

- Define Your Goals: What do you want to achieve in trading? Do you look at short-term or long-term advantages?

- Set Entry and Exit Points: Here, you are going to use signals of the Markoni indicator to set buy and sell entries.

- Incorporate Risk Management: You should always consider implementing the risk management strategies. Have stop-loss and take-profit levels so you do not lose your capital.

Common Mistakes to Avoid with the Markoni Trading Indicator

Misinterpretation of Signals

The most common mistake that a trader makes while he uses the Markoni indicator, is sign signal misconception. And therefore, with proper knowledge about reading signals right, he will be able to misunderstand it quite well. It would be quite beneficial practicing through a demo account if needed.

Over-Reliance on Indicators

The Markoni indicator may be very useful, but do not, by any means, depend fully on it for making trading decisions. Combine it with fundamental analysis and other indicators for a better approach.

Conclusion

In short, the Markoni Trading Indicator is a very useful tool which will make your trading strategy far better. Its components and how it works coupled with knowledge of proper application increase the accuracy of one’s trading decisions. On the other hand, despite all its advantages and disadvantages, it might bring good trading results when combined with other techniques and methods of analysis.

While charting your journey in trading, always do not forget to include good risk management techniques and not settle on a particular strategy since it can best get you the desired profit levels if you approach the right way using available technical aids such as the Markoni Trading Indicator.

Call to Action

Start your day today by using the Markoni Trading Indicator! Try to use the features and setup your trading approach based on it. Share your experience and insight while you navigate through markets with the rest of the world. Happy trading!

Frequently Asked Questions (FAQs)

Is the Markoni Trading Indicator Suitable for Beginners?

Yes, this Indicator is suitable for beginners but they need to understand how it works and use it in a demo account before placing real money trades.

Can the Markoni Trading Indicator Be Used for Different Markets?

Absolutely! The Indicator is very flexible and can be used on several markets like stocks, forex and commodities.

Must read our articles Do Indicators Improve Discipline in Trading?, Thinkorswim Show 20 Strikes at a Time, Futures Trading Indicators Thinkorswim and Flat Base Breakout Large Base Stock Pattern to Maximize Your Trading Success.

Read more about Trade at Stock Updates.

Post Comment