DIA Performance Return

Introduction

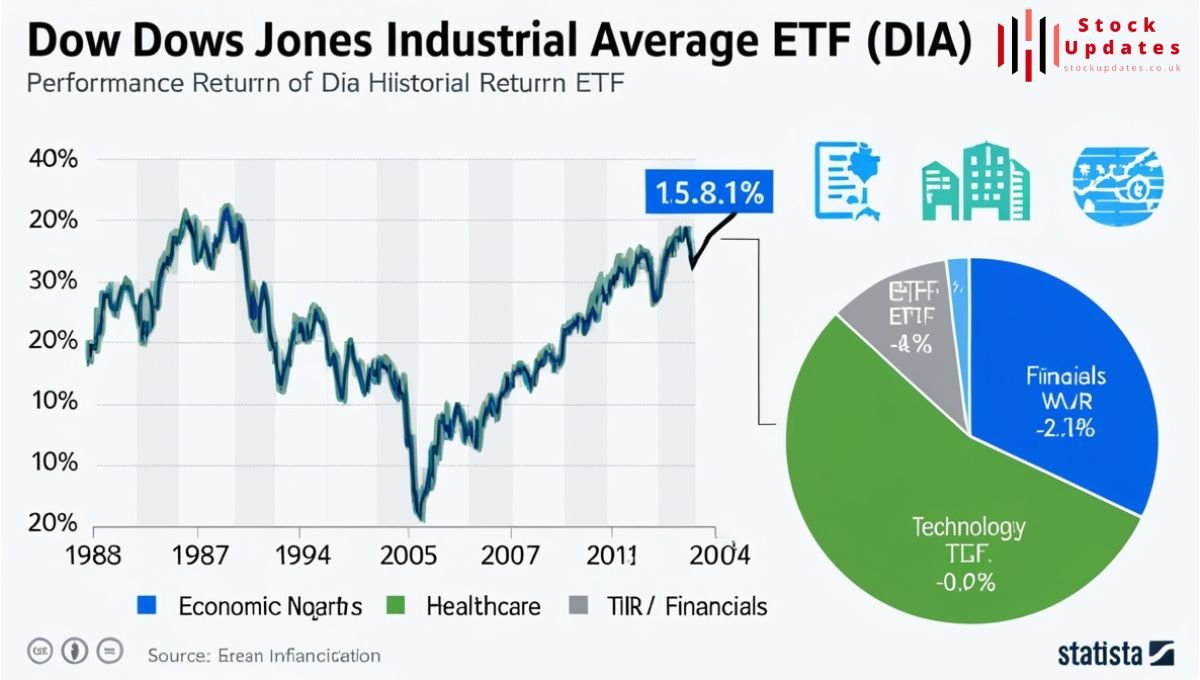

This paper aims at exploring the knowledge on performance measures essential for investment consideration in the investment world. Investors have a wide choice of financial instruments, but the most often used one is the DIA which stands for Dow Jones Industrial Average ETF. The DIA Performance Return is an ETF which investment management focuses on meeting the investment aims of emulating the DJIA – this is by investing in the shares of the 30 companies which constitute the index. In this blog, we will, thus, talk about the performance return on an investment in DIA by analyzing the historical data and its performance compared to other indices and touch on some factors associated with it.

What is DIA?

The Dow Jones Industrial Average is also a more complex index than the DAX insofar as it is a price-weighted index of the 30 largest share companies traded on the US market. It indicates the health of the U.S economy and it has monitoring role in stock market. The actual DIA ETF was created to trade shares of which provide the investors with good returns just like the DJIA; the DIA Performance Return was introduced to the market in 1998 by SPDR (State Street Global Advisors).

This paper focuses on the concept of performance

Performance returns give information on the realized profitability of any investment over a given period of time. The return is usually quantified in percentage terms so as to readily show the gains or losses for the investment made.

What is the DIA expense ratio?

The total expense ratio of the DIA which presented by the annual fee taken from the investors is 0.16%. Low expense ratio further extends this logic of going for it by investors who want to invest in the 30 blue-chip stocks in Dow Jones Industrial Average at an affordable cost that also gives a good returns on the overall market movement.

DIA Performance Returns Analysis

To gauge the DIA’s performance return, we can look at various time frames: monthly, quarterly, annual and Year to Date (YTD). The following table shows the DIA’s historical five year performance.

| Year | DIA Annual Return (%) | S&P 500 Annual Return (%) | NASDAQ Annual Return (%) |

| 2019 | 22.34 | 28.88 | 35.23 |

| 2020 | 7.25 | 16.26 | 43.64 |

| 2021 | 21.42 | 26.89 | 21.39 |

| 2022 | -8.78 | -18.11 | -32.97 |

| 2023 | 10.59 (YTD as of October) | 15.13 (YTD as of October) | 28.59 (YTD as of October) |

Yearly Performance Insights

1. 2019: A Bullish Year

The DIA Performance Return posted a robust return of 22.34%, benefitting from a strong economy and bullish market sentiment. Investors were optimistic due to low unemployment rates and increasing consumer confidence.

2. 2020: Resilience Amid Challenges

Despite the COVID-19 pandemic, the DIA managed a positive return of 7.25%. The market was poorly performing in March before regaining steam up to the present with contributions from the government and the Federal Reserve.

3. 2021: Continued Growth

The momentum carried into 2021, where the DIA achieved a return of 21.42%. The optimism on getting vaccines and reopening of economic activities was now boosting the market hence the gains of the ETF.o For the year 2022, the picture was somewhat different the DIA Performance Return contracted by 8.78%.turn of 22.34%, benefitting from a strong economy and bullish market sentiment. Investors were optimistic due to low unemployment rates and increasing consumer confidence.

4. 2022: Market Correction

The year 2022 proved challenging, with the DIA experiencing a decline of 8.78%. Such cost influencers as inflation, working capital costs and market instabilities due to geopolitical issues contributed to this decline in cost.o According to the DIA YTD Return, the value according to October 2023 was 10.59%.ted a robust return of 22.34%, benefitting from a strong economy and bullish market sentiment. Investors were optimistic due to low unemployment rates and increasing consumer confidence.

5. 2023: Signs of Recovery

As of October 2023, the DIA has recorded a YTD return of 10.59%. Recent examples of recovery include economic fundamentals and superior corporate earnings than anticipated.

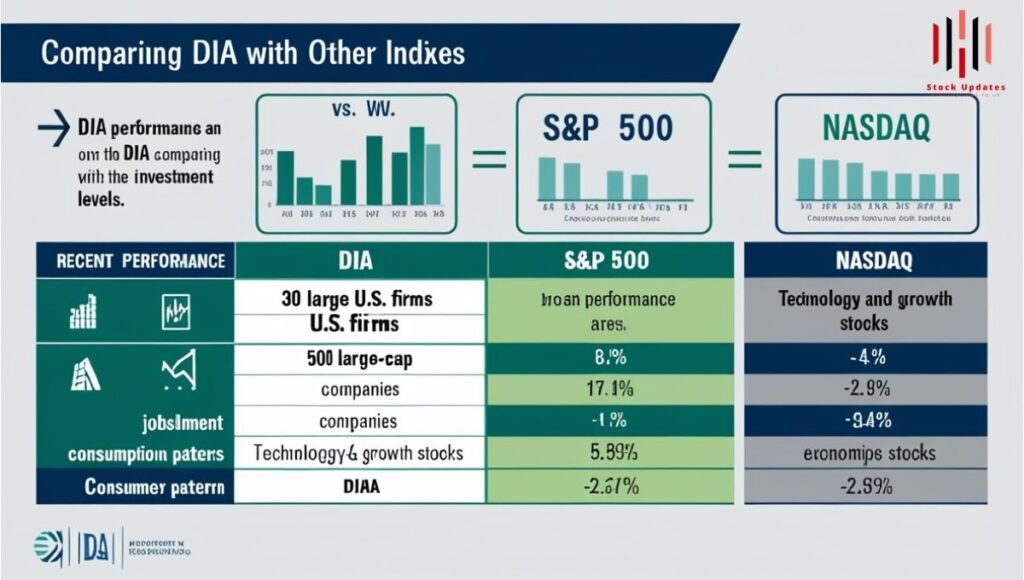

Comparing DIA with Other Indices

Evaluating the Factors That Impact Performance of DIA

Joblessness levels and consumption pattern are some factors that affect the growth of the firms comprising the DJIA. bay the S&P 500 and NASDAQ. The NASDAQ has more concentration of technology and growth oriented stocks.

For instance, in 2020 NASDAQ gave the highest return of 43.64% making it surpass all the indices worried as result of the pandemic on the tech sector.

Factors Influencing DIA Performance

1. Economic Indicators

Economic growth, unemployment rates, and consumer spending can significantly impact the performance of the companies within the DJIA. Strong economic indicators generally lead to higher stock prices.

2. Monetary Policy

Interest rate changes by the Federal Reserve can affect investor sentiment. Lower rates typically encourage borrowing and spending, positively influencing stock prices.

3. Global Events

Thus, fluctuations in political relations around the world, the intensity of the trade wars that have been launched, shifts in global economic activity also influence the results of the DIA. For instance, the COVID-19 brought a significant impact on market performance.

4. Corporate Earnings

The performance of the DJIA directly depends on the companies’ financials and, therefor, the financials should be interpreted in the same vein. Positive earning do signal and this call leads to stock prices to go up while negative earning does signal and this call leads to stock prices.

Risks Associated with DIA

1.Market Volatility

The stock market can be unpredictable, and the DIA may experience significant fluctuations, particularly during economic downturns.

2.Concentration Risk

The DIA Performance Return is heavily influenced by a limited number of companies. Poor performance from a few large companies can disproportionately affect the index.

3.Economic Sensitivity

Being tied to the performance of large industrial companies’ means the DIA can be sensitive to economic cycles, affecting returns during recessions.

Conclusion

By explaining performance return of DIA, it helps investors to make right decisions in the market of shares. Historical performance data portrays a mixed pattern of returns based on economic factors, global factors and corporate earnings. However, as we have seen, investing in the DIA provide diversification and liquidity; such investors should also appreciate the prospect of loss.

Therefore, as long as the market for ETFs like the DIA continues to grow, understanding performance metrics increases the investor’s chances of transitioning in the market. Each investor, regardless of his/her experience level, should pay close attention to performance returns in the course of creating a strong investment portfolio.

Read more about Market and other categories at Stock Updates.

Post Comment