What Insurance Company is RNA

The insurance firms have a significant function in offering of financial security and risk mitigation for the people as well as groups. Despite the great number of companies in this sphere, RNA (Reinsurance National Association) needs to be mentioned and it is useful to know how it works, what services it provides in the sphere of insurance, and what its difference from the similar companies on Insurance market is. In this blog post, you will find information about What Insurance Company is RNA history, structure, products and service, and its position in the context of other insurance providers. We will also look at how RNA functions in the precise area of reinsurance and how it influences policyholders and other insurers.

Introduction to RNA

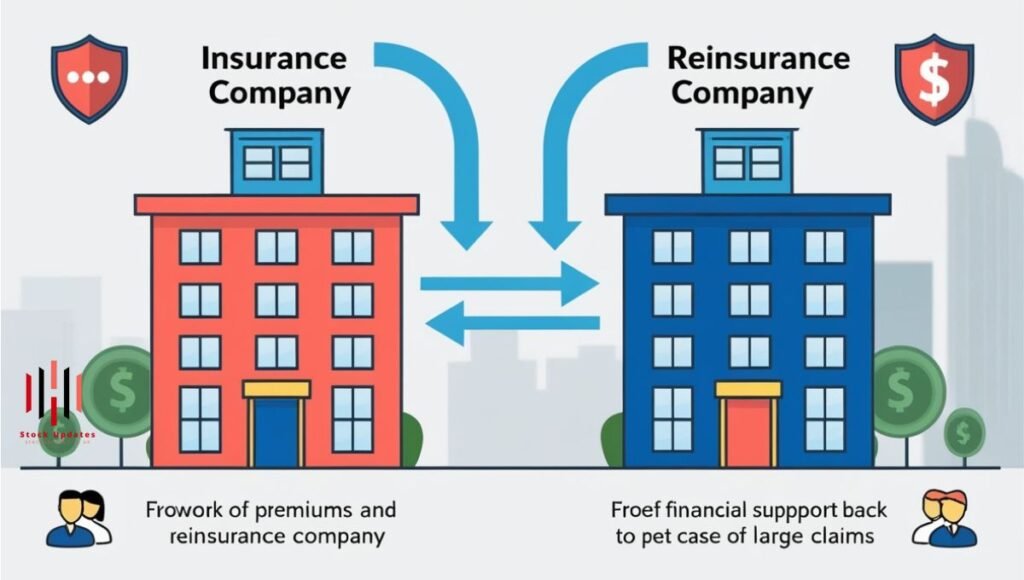

RNA or Reinsurance National Association is one of the most renowned reinsurance providers that help insurance companies to protect them from large scale risks. While most insurance related business entities directly underwrite and issue insurance policies to policy holders, What Insurance Company is RNA plays in the reinsurance market. This dichotomy places RNA as a risk management solution provider for insurance companies when addressing high risk claims, natural calamities, large scale events and other risks that may compromise the viability of insurance firms.

What is reinsurance and why is it important?

What really reinsurance is the fact that it is actually insurance for insurance companies. Insurance underwriters face the problem of setting themselves up for a large claim exposure when they underwrite policy risks. Hence, reinsurance companies such as What Insurance Company is RNA are instrumental in extending such risks since they take up part of the insurance company’s exposures. Such an agreement enable insurance firm to offer support to their clients with more confidence and with minimum risks to their financial muscle.

Key Benefits of Reinsurance

1. Risk Management

It reduces the overall claim costs, enabling insurers to meet bigger unpredictable losses.

2. Stability and Solvency

Through reinsurance, insurance companies are protected in the event that they are likely to bow to the charm of bankruptcy during disaster.

3. Capital Efficiency

Reinsurance provides the insurance firms with a chance to assume more risk hence expand their clientele base to cover more and more policies.

History of RNA

The background of What Insurance Company is RNA can be dated several decades ago, which was marked by the growing need for reinsurance connected with the frequency of natural disasters and economic crises in the world. As a response to growing requirements for greater financial support mechanisms within financial and insurance industry, RNA was created. In the years of its existence, RNA has opened its branch offices all over the world and is now among the largest reinsurance companies some of the insurance companies use a reinsurance service offered by RNA in different world markets.

The Mechanisms of RNA Structure and Regulation

The structure of RNA and all its processes are set up to be not only effective but also to be legal. It has a centralized management office with different regional subsidiaries making it viable to quickly adapt to the demands of the markets that they are covering. The RNA falls under local, national, and international policies and guidelines set by relevant authorities to meet regulatory concerns that seek to safeguard the interest of the clients and nursing the financial system.

The primary groups of regulators involved RNA in the United States are the National Association of Insurance Commissioners NAIC, which prescribes strict rules regarding capital buffers, disclosure and reporting. In the EU countries, RNA need to adhere to Solvency II regulation which aim to enhance the solvency of the insurance and reinsurance undertakings.

About RNA Products and Services

The goods produced by RNA are suitable for insurance companies in many sectors. Here are some of the key services they offer:

1. Property Reinsurance

Liability policy for insurers involved in property insurance market and disaster such as flood, earthquake and flood insurers.

2. Casualty Reinsurance

This would include reinsurance of general liability, workers compensation and auto insurance.

3. Life and Health Reinsurance

RNA reinsures life and health insurance products including death benefits, disability and out of pocket expenses.

4. Catastrophe Reinsurance

RNA operates in catastrophe reinsurance; this is insurance that acts as an indemnity against major loss due to catastrophes such as hurricanes, quakes and epidemics.

5. Specialty Reinsurance

RNA also serves small and specific markets like marine, aviation, agriculture and this gives insurance companies ways of managing risks attached to such areas.

RNA’s Function in Insurance Industry

It is unimportant to note that RNA has a critical function in the stability of the industry of insurance. Through reinsurance services, What Insurance Company is RNA helps different insurance firms avoid insolvency during occurrence of large claims. Its presence allows for a more robust insurance market and also helps insurers to increase the number of policies which it underwrites so it is not overwhelmed with risks. The cooperation with insurance companies also enables RNA to provide more individual services and high coverage to clients, and make a positive contribution to the overall service portfolio of the industry.

RNA Analytics

RNA is an analysis of RNA derived from genes to decipher and comprehend molecular communications, or Gene Expression. Thus, through sequence and expression analyses, scientists can gather information about possible functions of RNA molecules and rare cells and find out about potential treatments for numerous diseases.

Comparison Table: RNA vs. Other Reinsurance Companies

| Feature | RNA | Competitor A | Competitor B |

| Established | 1970s | 1950s | 1980s |

| Headquarters | New York, USA | Zurich, Switzerland | London, UK |

| Types of Reinsurance | Property, Casualty, Life, Catastrophe | Property, Casualty, Life | Life, Health, Marine |

| Market Share | 15% of global reinsurance | 20% | 12% |

| Financial Strength Rating | A++ (AM Best) | A+ (AM Best) | A (S&P) |

| Key Regulatory Compliance | NAIC, Solvency II | Solvency II | NAIC |

| Global Reach | Over 30 countries | Over 40 countries | Over 25 countries |

| Specialty | Catastrophe & Specialty Lines | Life & Health | Marine & Aviation |

RNA’s Financial Stability and Ratings

This clearly shows that RNA has always been in a very strong financial position, and this is usually a requirement that most organizations need to meet so as to attract large clients. The firm has sustained excellent rates from the independent imaginative agencies including AM Best and Standard & Poor’s suggestive of sound capital base, diversified risks and sound underwriting. These ratings also help insurance firms to develop confidence contracts that RNA can fund claims regardless of massive mishaps or market tumults.

- Financial Strength Ratings: AM Best Rating: A++ (Superior)

- Standard & Poor’s: AA (Very Strong)

- Moody’s: Aa2 (High Quality)

Such high ratings are essential which in turn affect RNA’s ability to secure reinsurance treaties with primary insurers, and guarantee its clients of its financial stability and ability.

PROS AND CONS OF RNA

There are some benefits of using RNA as a reinsurance provider as explained below; However the process has certain difficulties as well. Here’s a closer look:

Advantages

- Financial Security: High rating and a solid capital base are other attributes that give RNA’s clients the confidence.

- Global Reach: The presence of RNA in more than thirty countries also allows it to meet diverse regulatory and client requirements.

- Broad Coverage: RNA is involved in several reinsurance products with special reinsurance services such as catastrophe reinsurance.

Disadvantages

- Premium Costs: As expected, the service providers like RNA may charge highly due to their high ratings and wide coverage of the market environment.

- Complexity of Contracts: A few of the clients stated that RNA’s contracts are intricate because lots of legal expertise is usually needed to read through it.

- Market Competition: Nowadays, RNA competes with other large European reinsurance companies that might have better conditions for clients of some certain areas.

RNA Reinsurance and its Future

The future of RNA and its related reinsurance sector depends on a number of key factors such as; Climate change, Economic fluctuations, and Big data & analytics. Furthermore, RNA has taken part in advancing skills in predictive analytics and AI, skills that define the probability of risk and policies.

It is also aiming at increasing business on the life and health reinsurance because there is increasing demand for health covers as well as increased life expectancies. As a next step, RNA will need to sustain organizational learning and development in light of innovative solutions for emerging risks and regulatory compliance in the international environment.

Conclusion

RNA is one of the set pieces of the reinsurance industry which provides financial strength and solutions to insurance companies throughout the globe. The company’s highly diversified service portfolio, sound financial results and regulatory compliance make it a good provider for insurance companies. Nevertheless, due to its risk management and innovations, RNA is one of the most active market players, despite the mentioned challenges.

As RNA consolidates capabilities and looks forward and ahead, RNA remains a countervailing agent of stability and strength in a dynamic global insurance environment.

Read more about Insurance and other categories at Stock Updates.

Post Comment