Insperex Revenue: An Exploration of the Financial Lifecycle

It has taken sometime, yet Insperex Revenue must now be seen as one of the most significant players in the constantly shifting and ever-large world of financial services. Popular for its unorthodox selling and distribution of bonds and the market technology, Insperex decision making has placed it on the right side as a market disruptor. Kyle offers this blog on the revenue model, growth pattern, and the strategic factors that define Insperex’s financial outcomes.

What is the Revenue of Veonet Group?

Specializing in eye surgery, Veonet is a Munich not-for-profit group that runs more than 190 ophthalmology clinics in Germany, UK, The Netherlands and Switzerland. It also provides service to more than 1.2 million patients per year.

Revenues themselves are not known, however during a sale in 2021 Veonet was estimated to be worth between €2 billion to €2.5 billion.

The Genesis of Insperex

It was founded with passion to solve the challenges relating to fixed-income investment via the application of technology. Insperex Revenue works in an area that is located at the intersection of opportunity and need, using technology to address a fundamental need of bond trading that has remained underserved for years.

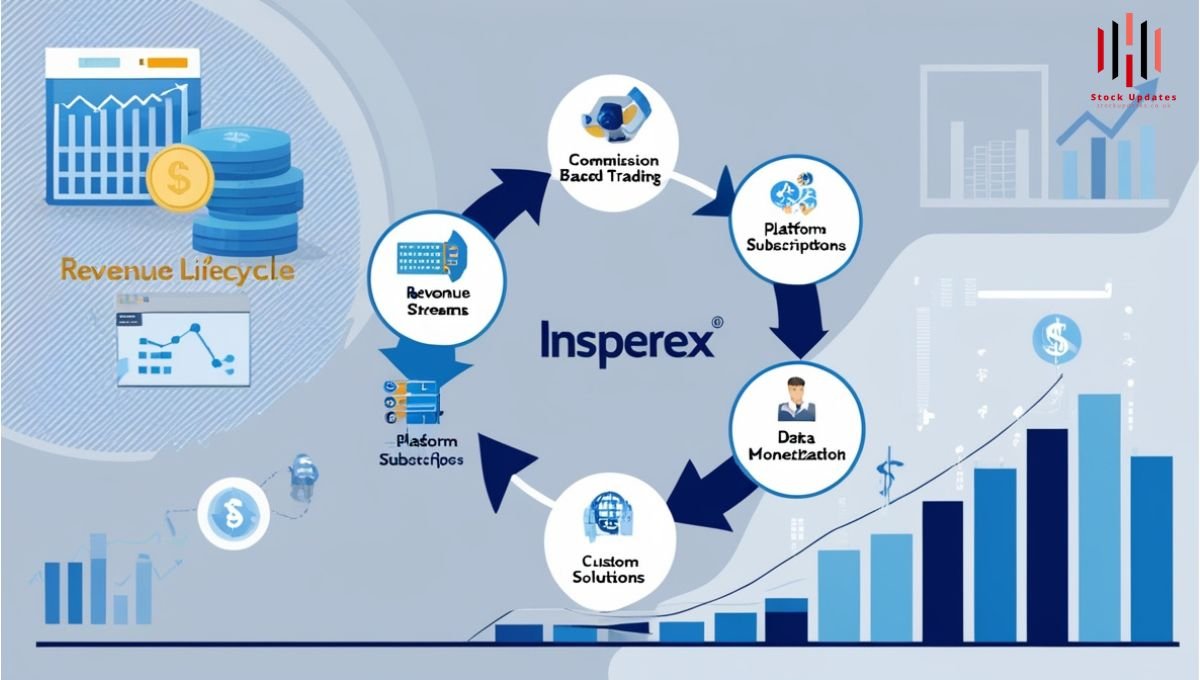

Revenue Streams of Insperex

Insperex has many sources of income and all are reflected in the Company’s financial growth and development. Let’s explore these key revenue streams:

1. Commission-Based Trading

About 60% of Insperex Revenue is in transaction-based commissions received in exchange for transactions made by its clients. The company generates revenue through charges for enabling the bond trades on its own platform to the buyers and sellers.

2. Platform Subscriptions

The firm sells accesses to its trading platform with subscription style that is for a given fee. They, institutional investors, financial advisors, and retail traders, tune-in to get more superior tools and analytics.

3. Partnerships and Collaborations

It offers products and services to banks, asset managers, and financial institutions while receiving its income from partnership contracts and licenses.

4. Data Monetization

Its platform is complex, and by gathering a significant amount of financial data, Insperex processes it. Another source of income is to act as a supplier of insights and analytics to the markets themselves.

5. Custom Solutions

The company is slightly specialized in developing customized fixed income strategies for large scale institutions earning higher fees for customization.

Revenue Streams Breakdown

| Revenue Stream | Contribution to Revenue | Growth Potential (2024-2028) |

| Commission-Based Trading | 45% | High |

| Platform Subscriptions | 25% | Moderate |

| Partnerships & Collaborations | 15% | High |

| Data Monetization | 10% | Moderate |

| Custom Solutions | 5% | Low |

Insperex’s Financial Growth

1. Historical Revenue Trends

Insperex Revenue has regard to, since the launch; the company has recorded phenomenal development. A relatively young firm that specialized in offering muni bond soon had the ability to expand its product range and entered corporate and structured bonds. It is this diversification strategy that has helped the organization record incremental growth in its revenue every other fiscal year.

2. Recent Developments

Insperex’s annual revenue scaled up to forty percent in 2023 compared to the previous financial year due to higher trading traffic and clientele. One of considerable growth in the case of BlackRock has been the adaptation of its platform by the mid-sized asset managers.

3. Forecasts for the year 2024 and further

Also, incorporating their forecast about future Insperex Revenue analysts say that Insperex’s revenues will increase at a compound annual growth rate, or CAGR of 30%.

Competitive Advantage

Insperex thrives in a competitive market due to its unique value propositions:

1. Technological Edge

Its modern platform unites artificial intelligence and machine learning and offers users predictive analysis and market trends.

2. User-Centric Design

This has pressed the developers to design the platform with the easy to navigate layout which has been widely welcomed by both financial advisors and retail investors.

3. Cost Efficiency

With the direct trading model free of middle men, trading fees at Insperex are cheaper across the board, bringing in all types of customers.

Challenges Ahead

Despite its successes, Insperex faces challenges that could impact revenue growth:

1. Regulatory Hurdles

It is noteworthy that Insperex Revenue is a financial technology company and works in the sphere that is closely regulated. Adherence to new or updated standards is always expensive and requires a lot of time.

2. Market Volatility

Due to volatility, the revenue in bond trading is dependent on the market situation. Low volatility could pull down the trading frequency: This is because besides the trading costs, other factors that influence the trading frequency include length of consecutive periods of low volatility.

3. Competition

Insperex is threatened by firms that have a larger market base, access to deep capital and offer close substitutes in the market.

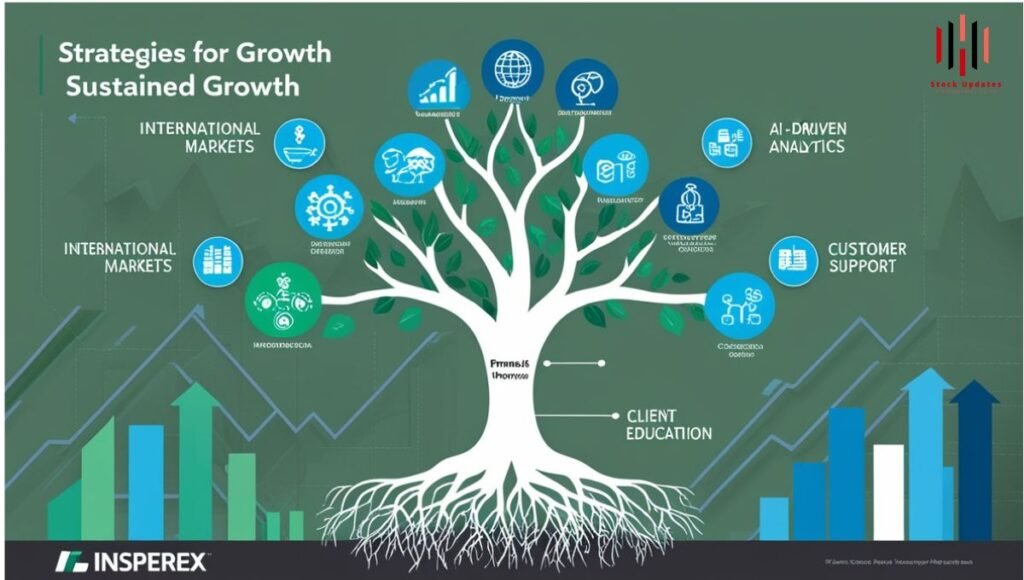

Strategies for Sustained Growth

To maintain its upward trajectory, Insperex must focus on:

1. Diversification

Diversifying, venturing into the international territories and launching new assets might reduce competition threats from current revenues.

2. Partnerships

Improved working relations with the financial institutions will ensure better revenues and wider market access.

3. Innovation

A businesses’ propensity to reinvest in technology and advanced AI analytical capabilities will help Insperex stay ahead in the market.

4. Client Education

Informing clients of the importance of investing on fixed income products may likely enhance adoption of its platform particularly the retail one.

Conclusion

Thus, the financial technology innovator is Insperex and it is a clear indication that the company has skills to adapt to different setting. This is probably why the company has been able to find its niche, especially within the fixed–income market through focus on transparency, technology and user experience. All these we see that there is possibility of sustainable revenue growth despite the challenges facing the company because of its strategy and positioning in the market.

Therefore, as Insperex grows, this revenue story will act as a beacon for financial technology companies thinking of challenging conventional industries. In this third millennium, potential investors, stakeholders, and clients seize their opportunities in Insperex as a leading brand in the ever-evolving financial services industry.

Read more about Market and other categories At Stock updates.

Post Comment