Crypto DeFi Terms: A Comprehensive Guide

Crypto DeFi Terms is enhancing the fund sector as well as presenting an innovative and secure opportunity for the global population to establish financial affiliations without needing to depend on mainstream organizations. Nevertheless, dealing with the DeFi requires some orientation since it largely filled with technical terms along with abbreviations. Here in this blog, we will explain the most basic but important DeFi terms to help you understand this revolutionary landscape.

What is DeFi?

Crypto DeFi Terms is short for Decentralized Finance, which is a network of financial platforms which use blockchain and do not involve middlemen such as banks and brokers. This enables users to engage the financial services through smart contracts that are program processes that run independently in Ethereum and other platforms.

How to Get Involved in DeFi

Getting started with DeFi requires installing a crypto wallet such as MetaMask combined with funding it using cryptocurrency such as ETH or BNB then connecting to platforms like Uniswap or PancakeSwap. Discover options for earning rewards through lending or staking or liquidity pool participation. Investors need to perform thorough project research together with complete risk assessment before making their investments.

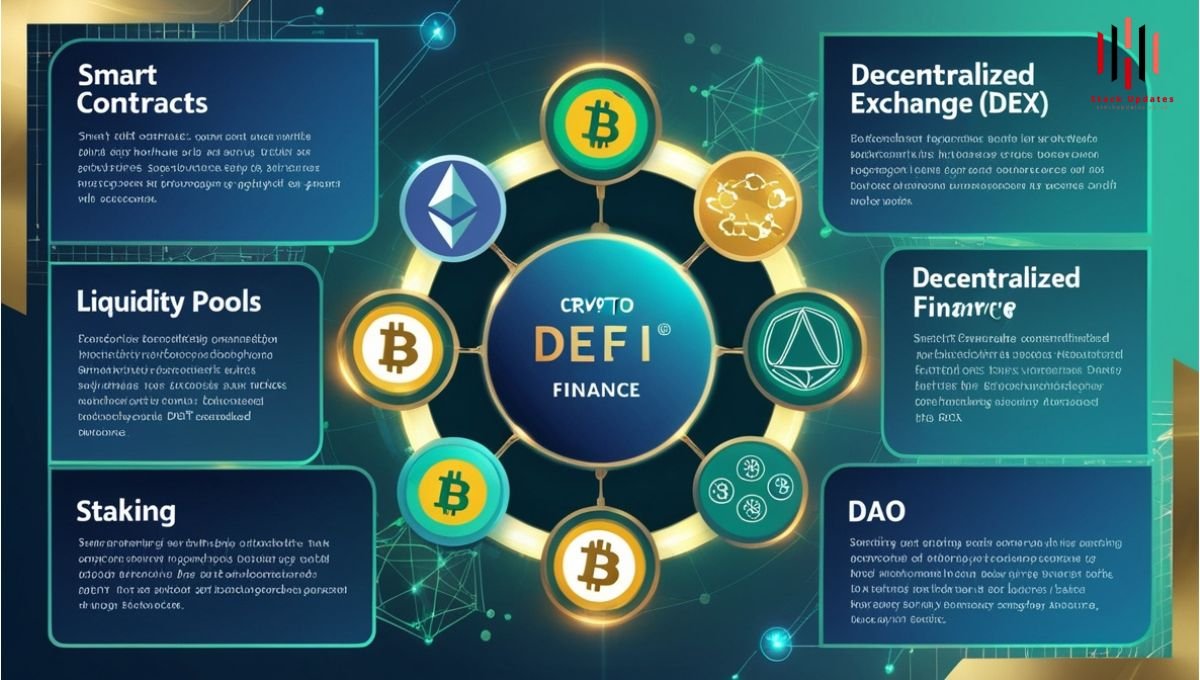

Key Crypto DeFi Terms

1. Blockchain

An open, distributed database that maintains a continuously growing record of activity in any computer network within the internet. Blockchain is the basic framework for Crypto DeFi Terms – it promotes openness, protects users from fraud, and does not allow data manipulation.

2. Smart Contract

An application that runs autonomously based upon the set of directions that it has been programed with. Smart contracts facilitate self-executing, and trustless trade in decentralized finance, with no interference from third parties.

3. Liquidity Pool

Pool of tokens placed in a smart contract for trading or lending or for carrying out various operations in Crypto DeFi Terms platforms.

4. Yield Farming

The process of receiving tokens on offering liquidity to the DeFi platforms or staking other assets.

5. Staking

Selection of procedures that involve staking digital currency in a blockchain network to help maintain that network, whereby the holder is usually compensated.

6. Decentralized Exchange (DEX)

An electronic system for exchanging virtual currencies peer-to-peer, meaning it does not involve a central agency. This is a class of decentralized exchange platforms though not as popular as centralised ones; popular ones are Uniswap, SushiSwap and PancakeSwap.

7. Governance Token

Providing users with an ability to make important decisions about the development of a DeFi project through a token. For instance, UNI token holder will be allowed to vote on the proposals that may be presented on the Uniswap platform.

8. Collateralised Debt Obligation or also known as synthetic CDO

Another is Peer to Peer lending where one user places a collateral such as Ether to be used to transfer another asset such as a stable coin.

9. Stablecoin

An asset-backed token which reduces price swings up and down in the hope of stabilizing it through an attachment to a stable value, such as the US dollar or gold. Examples or stablecoins are; Tether (USDT), USD Coin (USDC), and Dai (DAI).

10. Impermanent Loss

Provisional decline in value where liquidity providers are able to observe changes in the price of their deposited assets as they compare to the initial price they deposited the assets with.

11. Tokenomics

Definition of a token with particular regards to the economic context basing on the its total, circulating, and emitted supply, distribution, and roles in the DeFi marketplace.

12. Slippage

The discrepancy between the anticipated price of a trade and the price achievable at which the actual trade is made because of the fluctuating market risks or lack of liquidity.

13. Gas Fees

Fees given to miners / validators in order to enable them to confirm and verify transactions which occur on a blockchain platform.

14. Oracles

Business services through which blockchain networks receive off-chain data so that smart contracts can interact with other real-reality data.

15. APY (Annual Percentage Yield)

A commercial method of assessing the returns on investment as well as the interest earned on investment in an absolute manner to the calendar year.

Key DeFi Terms and Their Definitions

| Term | Definition |

| Blockchain | An open database which safely stores all records, including transparent records on each transaction. |

| Smart Contract | Smart contracts are those which operate on the blockchain platforms avail; able to execute themselves and perform transactions without the need for a third party intervention. |

| Liquidity Pool | A pool of funds locked in a smart contract, used for trading, lending, and earning yields. |

| Yield Farming | The process of earning rewards by providing liquidity or staking assets in DeFi protocols. |

| Decentralized Exchange (DEX) | Platforms allowing peer-to-peer trading of cryptocurrencies without intermediaries. |

| Governance Token | Tokens granting holders voting rights to influence the future of a DeFi project. |

Advanced Concepts in DeFi

1.Flash Loans

A kind of an unsecured loan that instead has to be both borrowed and paid back in the single transaction within blockchain. Indeed, the primary way that flash loans are currently utilized is for developers and traders to perform arbitrage and rebalancing functions.

2.Automated Market Maker (AMM)

A decentralized finance trading method that uses the calculation of the mathematical equation in the provision of the asset’s price so as to trade this asset without the order book.

3.Layer 2 Solutions

Hybrid solutions introduced as solutions on top of a blockchain to enhance throughput and lower charges. Such platforms are Optimism, Arbitrum, and Polygon.

Why Learn DeFi Terms?

It is important for anyone who wishes to play a role in DeFi to have a clear understanding of the terms used in this particular industry. Familiarity with these terms helps users:

1. Make Informed Decisions

People can understand the equilibrium of the DeFi platform so that they can easily evaluate the risks and gain benefits.

2. Maximize Earnings

Such terms as APY, staking, yield farming can lead users to make more effective investments.

3. Enhance Security

The knowledge of what impermanent loss is, how oracles work, or even what a governance token is, will prevent one from falling for scams.

Conclusion

When you know the terms and concepts covered above, you can harness the power of Crypto DeFi Terms regardless if you’re an investor, developer, or just plain curious. Getting to know these could appear quite daunting, though understanding these fundamentals shall enable one navigate in the decentralized financial realm.

Read more About Blockchain & Crypto and other categories At Stock Updates.

Post Comment