Middle Market CLO Fund: A Comprehensive Guide

Middle Market CLO Fund The financial system is a large category and in relation to investment there are many activities that an investor can pursue to generate his or her profits. Amongst these other complex and more recent graduating investment instruments that have dominated the financial market is the Collateralized Loan Obligation (CLO). More specifically, Middle Market CLO Funds are a distinguished segment of over-the-counter offers in the market of CLOs for small and medium-sized clients.

What is a CLO?

However, to proceed straight to the description of the middle market CLO fund it is important to know what CLO is. A CLO is a synthetic secured lending product where a manager sponsors a corporation that purchases a portfolio of loans – primarily corporate loans – and offers tranches of securities that are collateralized by these loan portfolios.

It offers high yield, diversification and credit risk factors that are not available at other areas of the market.

What is a Middle Market CLO Fund and how does It Work?

A Middle Market CLO Fund is a fund that wills mainly investing in CLOs that will target this middle market. Middle Market CLO Funds refer to those closed-end funds in which a significant and dominant part of the underlying loans belong to a relatively small, middle market companies. These funds allow the investor to get a diversified basket of loans and at the same time, get exposure to potentially higher yielding credit to middle market companies.

Principal Characteristics of Middle Market CLO Fund

1. Loan Composition

These loans are high risk yet have higher returns to serve as an indication of the level of risk inherent in this organization.

2. Structured Investment

In the same way that all CLOs are set up in various tranches, Middle Market CLO Funds are no different in the fact that they present different risk and return profiles.

3. Diversification

This diversification helps in ensuring that the upside of giving loans to small firms while avoiding the operators’ negative aspect.

4. Higher Yield

As a result loans of middle-market companies are riskier compare to loans of large companies and, therefore, the CLOs with such loans offer higher yields compare to the CLOs with loans of large firms.

Middle Market CLO Fund Investment: Why Should You Do This?

Investing in a Middle Market CLO Fund can be appealing for several reasons:

1. Higher Yield Potential

First, middle-market firms are inherently riskier investments than firms that are either large or small. This increased risk seems to be more often relay into higher returns which make Middle Market CLO Funds very appealing to investors in the market.

2. Diversification

Middle Market CLO Funds are structures that afford investors direct access to a diversified portfolio of loans from middle market companies of varying industries.

3. Access to Middle-Market Loans

Middle-market credit is both underserved by a number of traditional institutional investors, which can result in CLO funds finding loans to smaller companies that may be highly profitable.

4. Credit Quality

Middle Market CLO Funds can thus be associated with loans that belong to the lower to middle rating caliber which are investment grade.

5. Customizable Investment Options

Notes on Middle Market CLO Funds include ones whereby CLO Funds are available in trenching to attract various risk appetites.

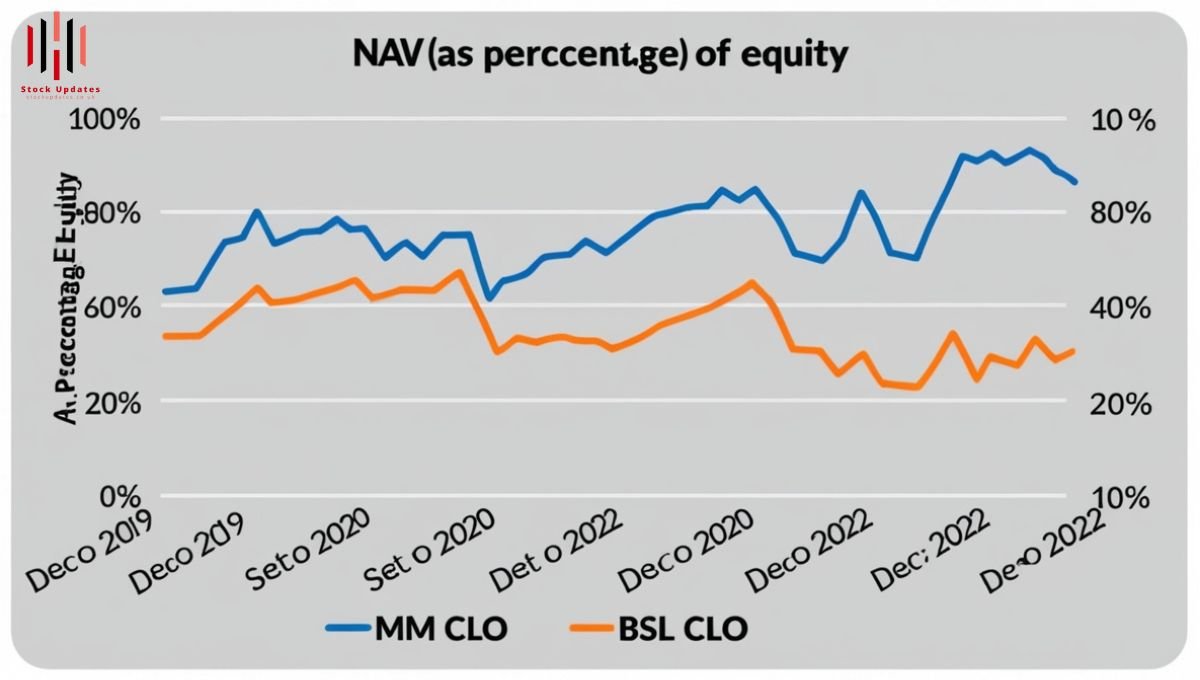

Middle Market CLO Asset Class

However, similar to any investment, Middle Market CLO Funds have their tails on risk factors as well. Some of the key risks include:

1. Credit Risk

The only major risk that is inherent with the Middle Market CLO Funds is credit risk. As much as the firms in this middle-market appear to be credit worthy they do experience volatile financial risks than their counterparts and this makes them to default on their loan more often.

2. Liquidity Risk

Investment in CLOs is relatively in liquid nature as compared with the common investments in shares and bonds. Although sometimes the investor holds an investment with an intention of selling before its maturity, they might experience problems in finding someone to buy the securities at the market price.

3. Interest Rate Risk

The value of CLO securities is inversely related to interest rates. Higher interest rates continually causes the broader CLO securities to be bought at cheaper costs especially those in the longer end of the yield curve.

4. Collateral Quality

The first risk is the quality of the collateral that backs the loans in a Middle Market CLO Fund. When the firm’s managing the loans face credit crunch, the assets that underpin the CLO also experience depreciation in value.

5. Market Risk

Market conditions create a large impact on the Middle Market CLO Funds performance. Default rates risethrough economic cycles or industry-specific shocks thereby decreasing the total amount of returns for CLO.

How Middle Market CLO Funds Operate

Similar to the more conventional form of CLOs, Middle Market CLOs are set up in different layers, which have different risks and possible profits. Below is a simple table illustrating the common tranches found in Middle Market CLO Funds:

| Tranche | Risk Level | Return | Priority of Payment |

| Senior Tranche | Low | Low | Paid first, least risk |

| Mezzanine Tranche | Medium | Medium | Paid after senior tranche |

| Equity Tranche | High | High | Paid last, highest risk |

- Senior Tranches: These are probably the safest of all investment instruments as they are repaid first in the event of a default. But the return is often much less.

- Mezzanine Tranches: These are middle hazards in terms of reward. They are paid after the senior tranches but before the equity tranches for the reason that they are used to reduce the risk of the junior tranches.

- Equity Tranches: These are the most dangerous but also those that can give the highest return on investment.

How to invest in a Middle Market CLO Fund

Becoming a partner in a Middle Market CLO Fund traditionally involves investing the large sum and the jumping through the barrier of accreditation. Other investors may also invest in ETF or mutual funds that invest in CLO paper as a way of having indirect exposure to the assets.

Conclusion

Middle Market CLO Funds provides the investors with an opportunity to invest in a diversified middle-market company loan pool. Any pe investor considering making such investment should first establish the various factors existent in this type of investment and determine whether it suits their investment objectives and risk taking ability.

Read more about Market and other Categories At Stock Updates.

Post Comment