What is CLS in Insurance

What is CLS in Insurance It is a marketplace full of technicalities and abbreviations which might be daunting to a lady from the insurance industry. There is also the Collateralized Loss Settlement term, abbreviated as CLS. As such, it is important that people engaged in any high-risk, highly-valued financial or property business, have comprehensive knowledge of CLS.

Understanding CLS

Although What is CLS in Insurance is more or less embedded in the insurance as well as risk management it has the primary purpose of enhancing timely and certain gilt edged settlement of claims. The latter can be cash, letters of credit or any other cash like utilizable instruments that would be acceptable for immediate payment.

Key Features of CLS

1. Risk Mitigation

What is CLS in Insurance assures that adequate funds are available to meet the claims as and when they arise minimizing, where possible, delays or dispute on the availability of cash to meet the obligations.

2. Transparency

There clarity of rights and responsibilities between the insurer and insured on how the financial responsibility will be met.

3. Liquidity

This is because through the use of liquid collateral in securing the claims, the process undergoes a fast process of settlement.

4. Flexibility

The balance of service provided by CLS can be adjusted according to the needs of CLS and the party receiving the services, bearing in the mind the risk tolerance and previous claims history.

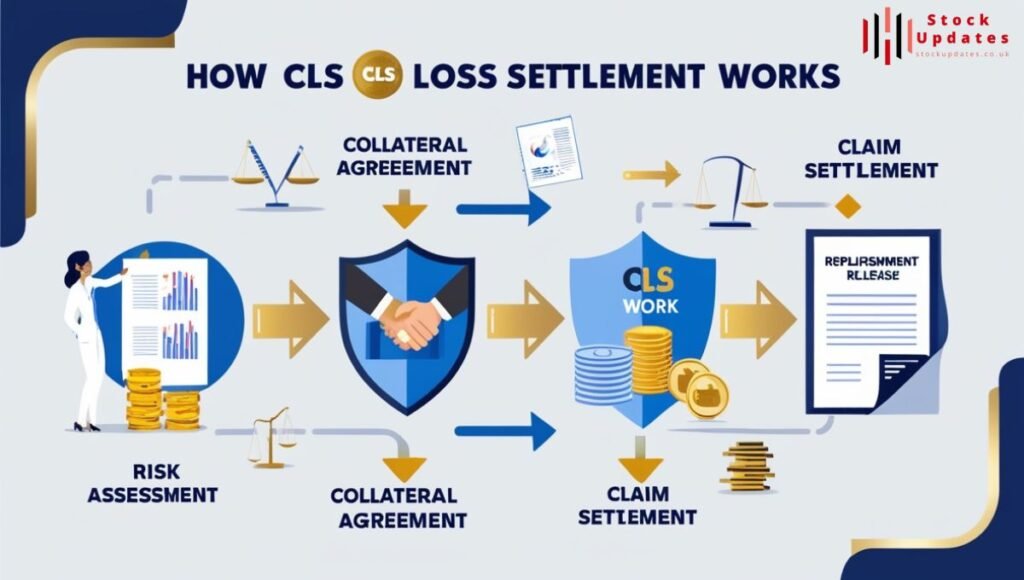

How CLS Works

1. Assessment of Risk

The insured’s risk characteristics are reviewed to determine its ability to generate claims based on past history, operations and possible risk exposures.

2. Determination of Collateral

These amounts can be related to the risk level of the insured as well as the policy terms that exist between the insurer.

3. Collateral Agreement

The insured tender an agreed form of security to the insurers which is in the legal custody of the third party.

4. Claim Settlement

If there is a loss experienced, the insurer has the opportunity to use the collateral in order to pay the claim expeditiously.

Advantages of CLS in Insurance

| Feature | Benefits to Insured | Benefits to Insurer |

| Guaranteed Claim Payment | Ensures claims are paid promptly. | Reduces the risk of disputes and legal costs. |

| Enhanced Trust | Builds confidence in the insurer. | Improves reputation and customer loyalty. |

| Risk Sharing | Reduces financial strain during claim settlement. | Helps manage high-risk policies effectively. |

| Efficient Settlements | Speeds up the claim process. | Reduces administrative burden. |

CLS in Practice

Industries with Positive Impact of CLS

- Construction: For events occur such as project overrun or accidents that may affect companies incurred a lot of risks.

- Energy and Utilities: High net worth assets and possible losses are resolved by CLS through protection against major claims.

- Shipping and Logistics: Losses can occur in the form of accidents that give rise to costly claims or a missing cargo.

Case Study: CLS in Action

A large construction firm across multiple locations struggled with long terms of claim reimbursement that affected business cash flow and projects time frame. After adopting What is CLS in Insurance, the firm experienced:

- Reduction in Claim Settlement Time: From months to weeks.

- Improved Financial Stability: All projects are financed properly without interruption.

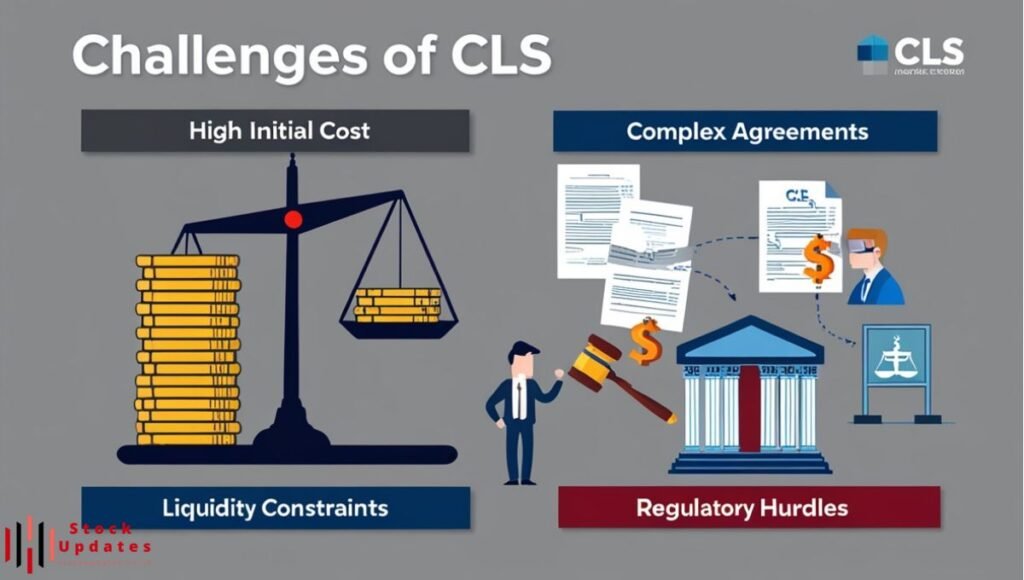

Challenges of CLS

Despite its benefits, CLS has its challenges:

1. Complex Agreements

Sometimes the terms and conditions may need the intervention of lawyers when negotiating.

2. Liquidity Constraints

The use of assets for pledge hinders financial capacity.

3. Regulatory Hurdles

Every region and country has its set of rules governing insurance and it may not always be easy to deal with them.

The Future of CLS

These changes affecting CLS suggest that there is still more room for growth in technology as well as data analytics. Here are some trends shaping its future:

- Blockchain Integration: Improvement in the openness and safety of relating to collateral.

- AI-Driven Risk Assessment: Better estimate of the quantities of the collaterals.

- Global Standardization: Initiatives to achieve the convergence of CLS practices worldwide.

Conclusion

Collateralized Loss Settlement (CLS) implies a truly groundbreaking concept in insurance business. These issues make risk management a crucial aspect of any insurer-insured relationship and What is CLS in Insurance because it helps settle claims quickly. It does have its limitations though as we have seen above, however, its benefits help to make it a necessity in the high-risk insurance situations.

With technology continuing to play a significant part in the functioning of this Industry, CLS is only going to grow stronger and more efficient over the years to come to the benefit of commercial organizations and the wider population. Insurers, business people and individual policyholders will benefit from gaining knowledge about CLS for purposes of proper formulation of risk management strategies.

Read more about Insurance and other categories At Stock Updates.

Post Comment