Elliott Wave Correction of Expanding Wedge: Essential Trading Tips

Introduction

The theory of Elliot Waves is one of the most influential tools applied in analyzing a financial market. It is a good thing to be able to identify trends as well as the reversals of price movements between the trader and the market. One important pattern in this theory is the Elliott Wave correction of expanding wedge. This says a lot about enriching your trading strategy. In this article, we will delve into what an expanding wedge is, how it fits into the whole Elliott Wave Theory, and give essential tips for trading it successfully.

Understanding the Elliott Wave Correction of Expanding Wedge Pattern

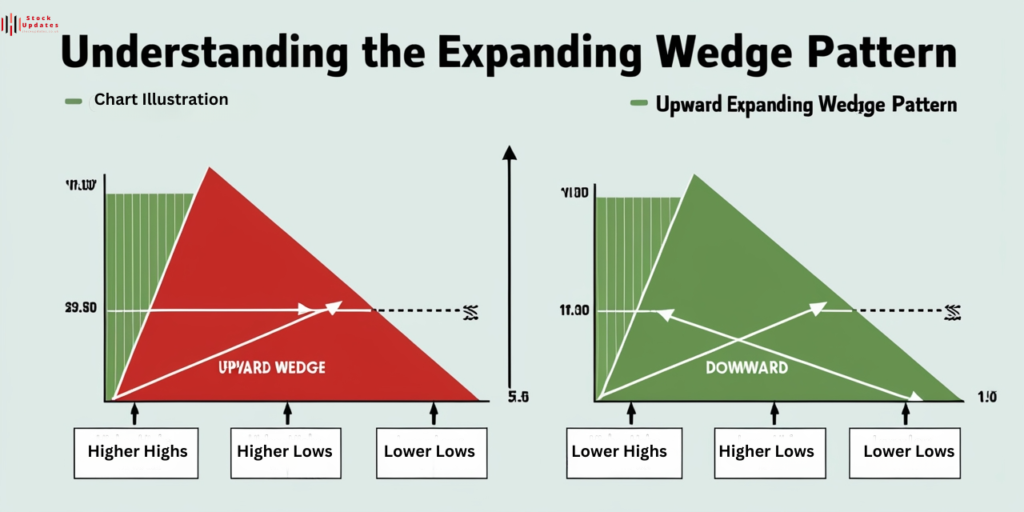

The expanding wedge is one of those rare chart patterns whose price movements are moving in a diverging manner. The upward expanding wedge will have an upward price with higher highs and higher lows, while a downward expanding wedge will be recording lower highs and lower lows.

Key Features of the Expanding Wedge

- Higher Highs and Higher Lows: In this upward wedge scenario, the price produces a sequence of higher highs. It also forms successively higher lows that develop into a constricting range leading to a breakout.

- Lower Highs and Lower Lows: The price does move in the opposite direction of an upward thrust during a downward wedge. It results in successively lower highs and lower lows, thus indicating growing volatilities.

Visual Examples

Visualizing the opening wedge may also help explain its characteristics. Consider an upward wedge price chart. Lines connecting the highs and lows diverge as the price is moving upwards. This pattern indicates potential turnaround points in the market.

The Role of Elliott Wave Correction in the Expanding Wedge

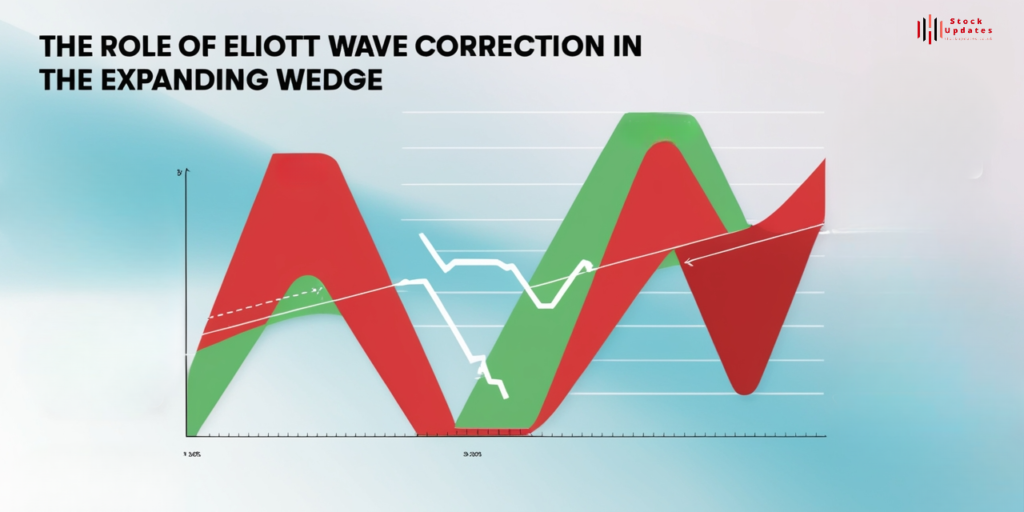

Understanding the Elliott Wave correction of expanding wedge forms a very important area in efficient trading. In this regard, through the context of Elliott Wave Theory, the expanding wedge usually manifests at corrective phases.

Identifying Corrective Waves

In Elliott Wave Theory corrections can be tricky. Often, an expanding wedge marks a terminating point of a higher trend. When you find that pattern, in most cases, the price is ready to change direction. You would be able to make better trading decisions by looking at these correction waves.

Differentiating Between Types of Corrections

Elliott Wave Theory describes several types of corrections, including zigzags and flats. The expanding wedge is unique in nature being divergent. Knowing the difference will let you understand better what happens in the market and make smarter trades.

Trading Strategies for the Expanding Wedge

A clear strategy is needed for trading the expanding wedge. Here are some pertinent tips to consider.

Identifying Key Entry and Exit Points

Identify the correct levels of entry and exit into the expanding wedge Elliott Wave correction. Usually, one would look for a breakout above the upper trendline for a rising falling wedge, and below the lower trendline for a falling rising wedge.

Confirming Breakouts: Indicators and Tools

Use different indicators for confirmation of breakouts

- Volume Analysis: Whenever there is a tremendous volume spike, it may represent a valid breakout. Take notice of where you obtain spikes in volumes as you approach the trendlines.

- Momentum Indicators: These indicate whether the asset that you are trading is overbought or oversold. Tools such as RSI allow you to ascertain if you should enter a given trade.

Essential Trading Tips for Effective Execution

- Wait for Confirmation: Do not rush into a trade upon observing a wedge. Always wait for confirmation of breakout so as to avoid trading based on some fake signals.

- Use Limit Orders: In entering a trade, be sure to utilize limit orders so you can grab the preferred price. This reduces risk and might help manage risk.

- Set Profit Targets: Although you can initiate a trade, state your profit targets before a trade is initiated. It provides an exit clearly and keeps you disciplined.

Risk Management Techniques

This Risk management helps to manage or gain mastery over the risks of trading. Here are the strategies predominantly used in the Elliott Wave correction of expanding wedge.

Importance of Risk Management in Trading

Risk management involves identifying the losses and measures to reduce those losses. After taking such risk management moves, you will be protected, and your capital will be protected, which will help you to stay in the game for a relatively longer period.

Strategies for Setting Stop-Loss Orders

A common technique is to enter stop-loss orders just outside the wedge. For instance, if you are buying at a breakout place a stop-loss below the last low. In such a case if the trade goes against you, you won’t lose more than your investment.

Position Sizing and Its Impact

Determine your position size based on your risk appetite. A popular guideline is not to risk more than 1-2% of your trading capital on any given trade. This way, you will be able to survive any losing streak and stay in the market longer.

Psychological Aspects of Trading the Expanding Wedge

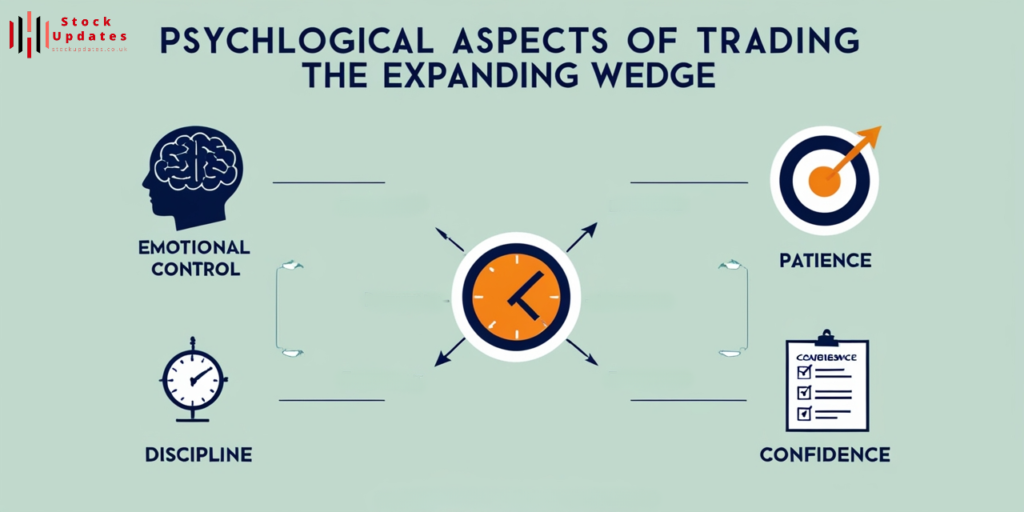

Trading is not only charts and patterns, but it’s psychology too. Controlling emotions makes a huge difference in the winning trades.

Controlling Emotions in Trades

Erroneous judgment of emotion. Calm down and keep following your trading plan. If you feel that some overwhelming emotion is affecting you, then take a step back, re-evaluate the strategy.

Developing a Disciplined Trading Approach

A disciplined trading strategy means respecting the strategy and never letting emotion take over your decision. You must have entry and exit rules and apply them at every deal.

Importance of Patience and Observation

Trading requires patience. You may miss some of the best opportunities if you don’t wait for the perfect setup. Take your time to observe what is happening in the markets, analyze the different patterns that are developing, and wait for confirmation before acting.

Common Mistakes to Avoid

Even professionals are likely to commit some errors. Some common mistakes to be on your lookout for, in trading the Elliott Wave correction of the expanding wedge are.

Misinterpretation of the Expanding Wedge Pattern

Not all wedge patterns signal a reversal. Sometimes, they just continue the same way. Always verify before you decide to trade on a wedge pattern.

Overtrading During Corrective Phases

It becomes tempting to trade during corrections, but this usually leads to losing edges. Hold out to your strategy and only trade when you are seeing clear signals.

Neglecting Broader Market Context

Do not forget to see the bigger picture. Economic news as well as events can greatly affect movements of prices. Always know what is happening in the market that may influence your trade.

Conclusion

It is just a correction of an expanding wedge in the Elliott Wave, and it needs to be known by the market to trade profitably. Knowing this pattern and trading with appropriate strategies will increase your chances of success in the market.

Don’t forget to manage your risks and control your emotions. With patience and discipline, you’d overcome all the intricacies of trading and take the market by storm.

Read more about Trade at Stock Updates.

Post Comment